English

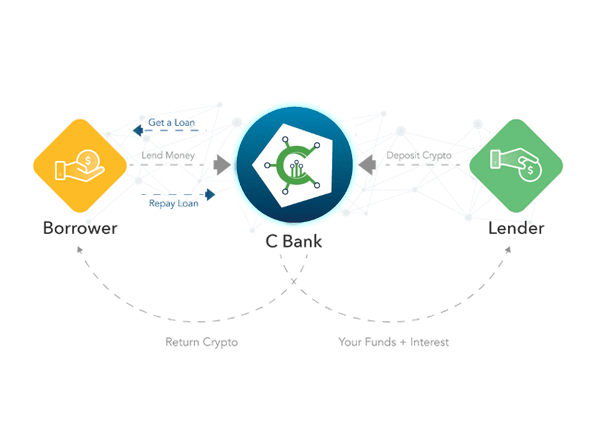

Deposit fiat funds or stablecoins if you want to lend. Deposit cryptoassets to secure a loan if you want to borrow.

Find the most suitable offer to issue a loan instantly or create a custom one.

Borrowers commit to paying interests on time. Otherwise, cryptocollateral ensures this.

Once the loan is paid off, the lender gets funds and earned interests. Сryptoassets return to the borrower.

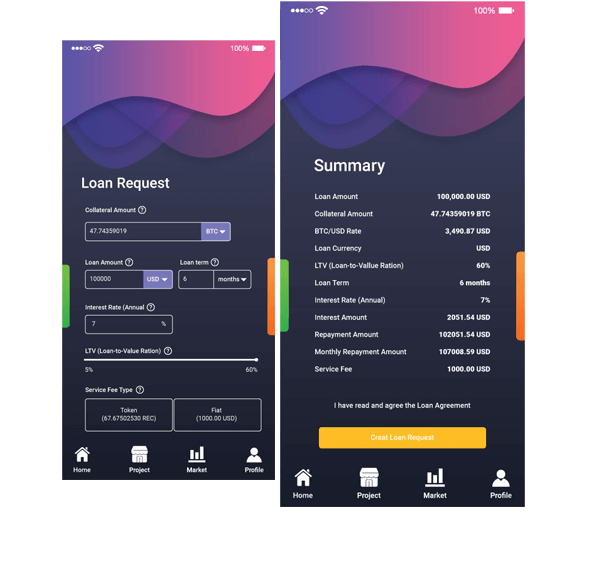

Use your crypto as collateral to get a loan without credit checks.

No need to sell cryptoassets to get money. Borrow cash against your crypto and get collateral back after pay-off.

There is no need to check the credit history and prove your payment capacity.

Get a loan in fiat or stablecoins for a period from 7 days to 3 years. Early loan repayment without extra fees and penalties.

Various payment methods to withdraw borrowed funds quickly.

C-Bank matches lenders and borrowers, acting as a custodian by delivering a safe and clear lending experience.

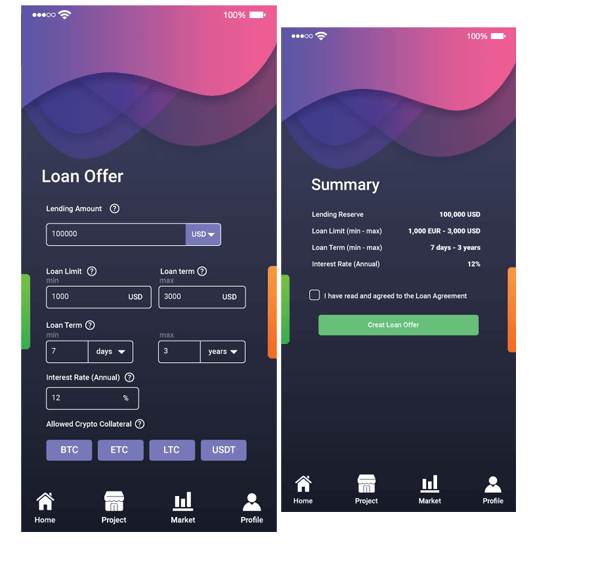

Borderless lending opportunities are available for lenders from anywhere in the world.

Variety of Currencies Loans can be issued in fiat currencies (USD, EUR, GBP, RUB), cryptocurrencies (BTC, BCH, ETH, LTC, XMR) or stablecoins (TUSD, USDC, PAX, DAI, USDT, EURS, BUSD).

The C-Bank is licensed as a financial institution. Fully legal status and protected infrastructure ensure the security of funds.

The C-Bank platform operates worldwide with small restrictions due to regulations.Hacking attempts, bots, and DDoS attacks are filtered out meticulously thanks to Web Application Firewall and DDoS Protection.

To keep the platform and customers’ funds safe, we utilize the strictest security standards as the financial institution does.

To prevent security breaches, we have a bug bounty program, account takeover protection system, regular vulnerability scans, and, for sure, two-factor authentication that protects your account.

Thanks to overcollateralization and automatic liquidation system, the volatility of the crypto market never affect lenders. The C-Bank platform the time it's operational, Since then, every lender received their funds in full and on time.

In the case of non-repayment, the platform will automatically sell a part of the borrower's collateral to pay his dues in time. If the value of crypto-collateral drops significantly, the system liquidates it to repay the principal and interest in full.

Borrowers risk losing collateral in case of a non-repayment or a significant fall in the crypto value. To prevent this, we recommend to borrow a loan with the low LTV, monitor your loan info regularly, and make payments on time.

LTV fluctuations indicate the health of your loan’s collateral. If the price of the crypto-asset falls, the LTV will increase. As soon as it reaches 80%, you’ll get an email alert. To prevent liquidation at this point, you can add more collateral or repay a part of the loan earlier.

If you do nothing, collateral liquidates automatically after the LTV crosses a ~90% threshold.

The C-Bank platform operates worldwide with small restrictions due to regulations.

Thanks to overcollateralization and automatic liquidation system, the volatility of the crypto market never affect lenders. The C-Bank platform became operational in July 2018. Since then, every lender received their funds in full and on time.

In the case of non-repayment, the platform will automatically sell a part of the borrower's collateral to pay his dues in time. If the value of crypto-collateral drops significantly, the system liquidates it to repay the principal and interest in full.

The C-Bank platform operates worldwide with small restrictions due to regulations.You can use debit and credit cards of almost every bank in the world to deposit euro. It is possible to deposit from any card in any currency. The system will automatically convert your funds into euro according to your local bank exchange rate.

There are other methods available to deposit fiat funds. Those include SEPA, SWIFT, AdvCash, and others.